Why do I need access codes?

Nordea access codes are a means to verify your identity so you can securely access online services and call our Customer Service. You can use your access codes to:

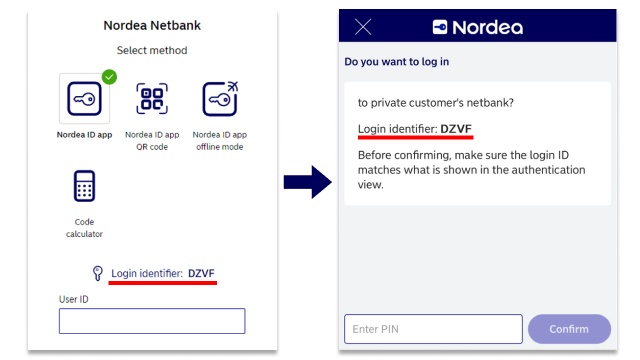

- log in to our banking services, including Nordea Mobile and Netbank

- confirm card payments and other payments you make online

- verify your identity when you call us

- access other public online services when your access codes include strong electronic identification.

.svg)