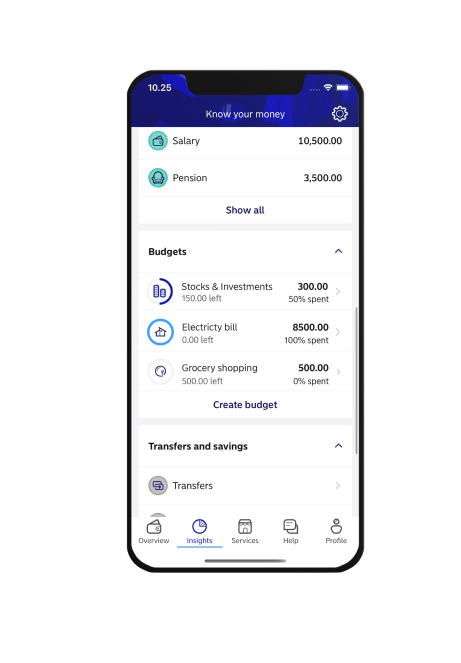

For students who are 18 or older and live on their own in the Greater Helsinki area, the study grant and housing supplement total 575.38 euros per month. After rent and other essential expenses, it’s inevitable that there is little money left.

“Rents are high in the Greater Helsinki area. If you don’t have any other income, you maybe have twenty or thirty euros to spend on other things,” Anton says.

Because of this, many students finance their studies with a student loan, by working or by combining both of these sources of income.

Anton has spent most of his student loan on day-to-day expenses, but he has also been able to put some of it aside. During certain periods, the student loan has enabled Anton to focus on his studies better.

Emma has chosen to work while studying to get money and to gain experience.

“By having a stream of personal income while I study, I have been able to secure my daily life, and I haven’t needed a student loan,” she says.

Iris, who works part-time, has continued to draw down her student loan.

“My student loan works basically as a buffer, and I can sometimes use it to enjoy life.”

Read more about working while studying

.svg)