How big a student loan can I get?

The amount of student loan you can get was increased in August 2024. Your student loan amount depends on how old you are and where you study.

The table below contains the maximum amounts of student loan students in different situations can get per month and per academic year. You can get nine months of student financial aid per academic year.

| Who? | Amount (euros per month) | Amount (euros per academic year) |

| Other than university student (under 18 years old) | 400 | 3,600 |

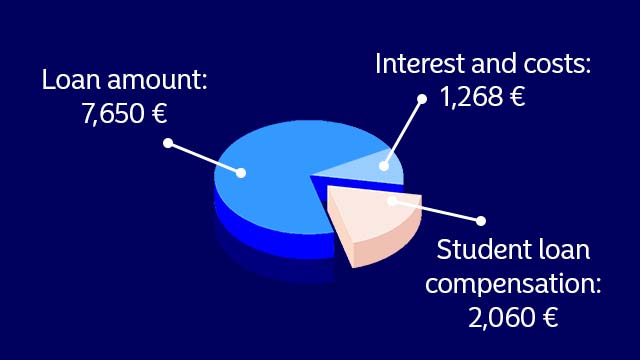

| Other than university student (18 or older) | 850 | 7,650 |

| University student | 850 | 7,650 |

| Students studying abroad | 1,000 | 9,000 |

If you’re uncertain about how you qualify, you can check your maximum student financial aid with Kela’s calculator.

.svg)