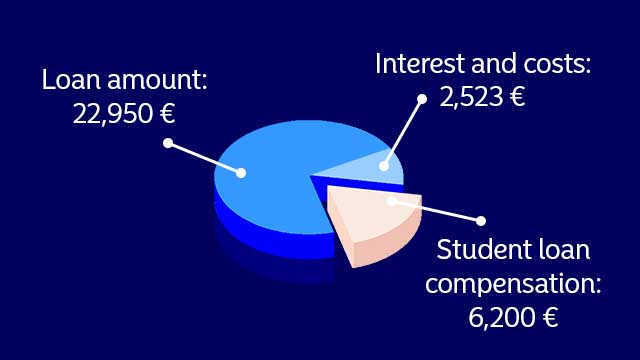

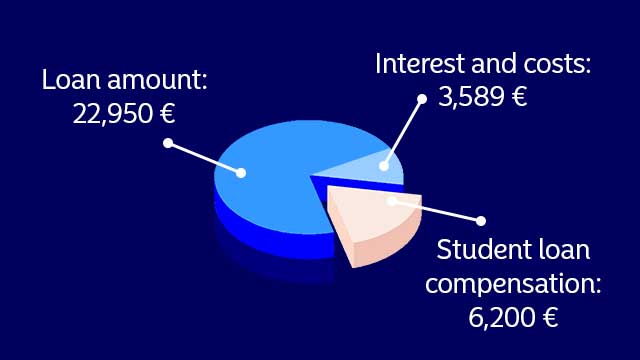

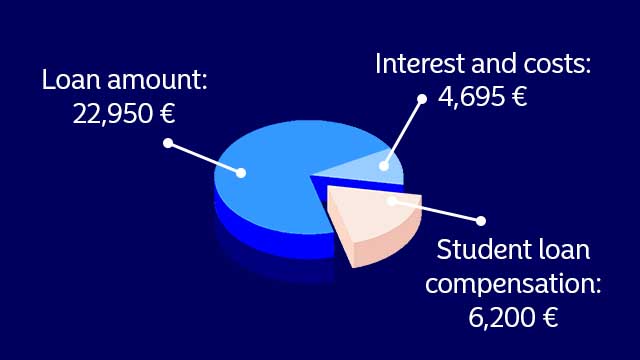

Calculation with a reference rate of 2%| What is included in the amount? | Amount (€) |

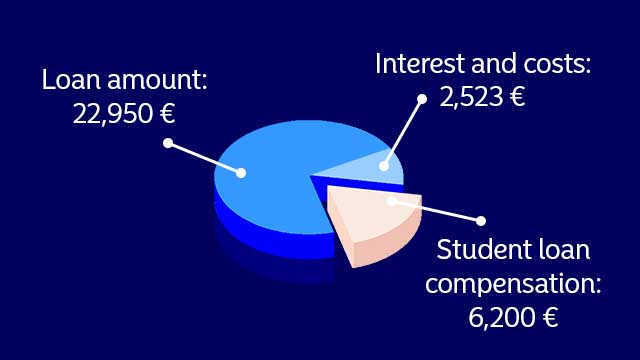

| Loan amount | 22,950 |

| Interest and costs (during your studies) | 2,523 |

| Loan, interest and costs in total | 25,473 |

| Student loan compensation* | 6,200 |

| Total repayment (principal + interest + costs - student loan compensation) | 19,273 |

| Repayment schedule (15 years) | |

| Monthly loan payment (excluding interest) | 106.91 |

Interest and costs during the repayment period

| 4,711.01 |

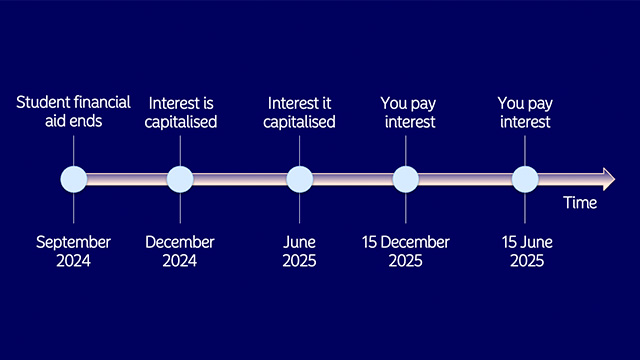

Please note that the calculation is indicative and assumes that interest and costs remain unchanged throughout the loan period. Also consider that the calculation is based on the assumption that the student has completed a Bachelor’s degree and a Master’s degree in Finland (5 years and 300 ECTS credits) and received student financial aid throughout their studies.

The amount of the state guarantee for your student loan depends on how old you are and where you study. The calculations are based on the maximum student loan amount of 850 euros per month for students studying at a Finnish university. Capitalisation of interest, partial drawdowns, repayment months, extra payment holidays and breaks in your studies have an impact on the interest and the costs, which is why your loan details may be different from those presented in the calculation. The reference rate of the example calculation is the 12-month Euribor with a hypothetical quotation of 2%.

*The student loan compensation is 40% of the amount of your outstanding student loan exceeding 2,500 euros, but not more than 6,200 euros.

Read more about student loan compensation

.svg)