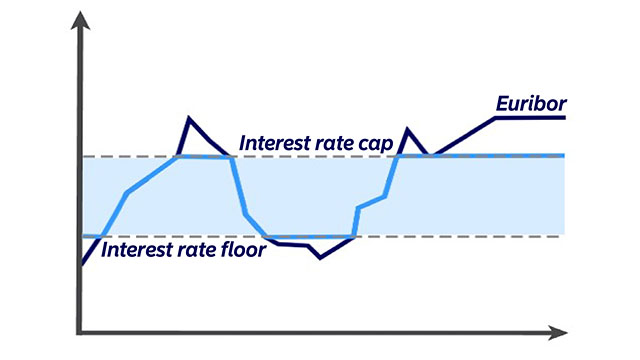

Why buy an interest rate collar?

By adding an interest rate collar to your loan, you can protect your loan against changes in its reference rate for years to come. An interest rate collar won’t prevent you from making changes to your repayment schedule, which means that you can apply for a payment holiday and use FlexiPayment, for example.

- The monthly loan payment is typically the largest single expense in a household. By hedging against the interest rate risk, you ensure stable finances even in an unstable environment.

- You can flexibly adjust your loan’s repayment schedule.

- If you opt for an interest rate collar, you won’t have to pay a separate hedging fee like with other hedging products.

.svg)