How to manage your recurring payments and subscriptions

You can easily track and manage your recurring payments and subscriptions under Subscriptions. You can also cancel subscriptions directly in Nordea Mobile.

To use the Subscriptions feature, you will need to have version 4.22 or newer of Nordea Mobile.

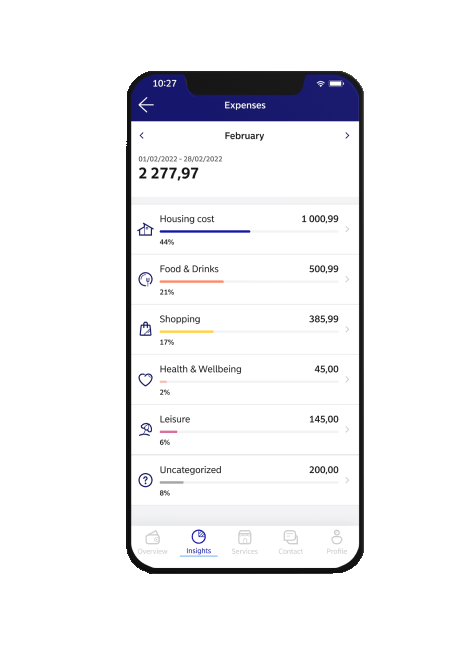

How to track subscriptions

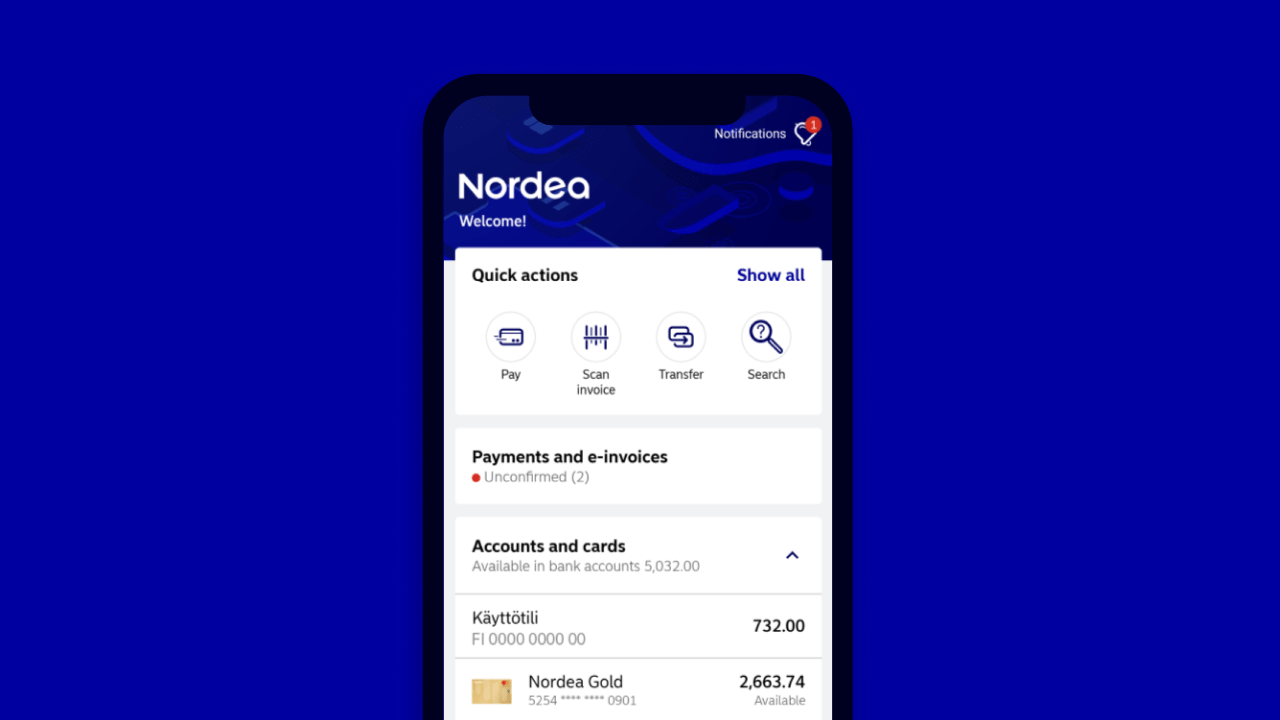

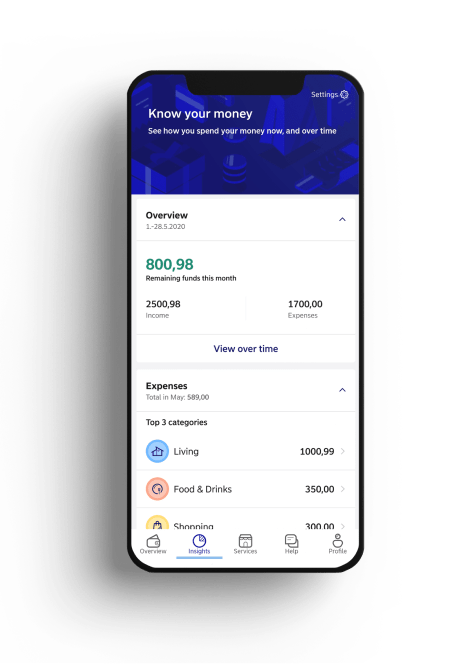

- Go to the Insights tab in Nordea Mobile.

- Scroll down and select Subscriptions.

- You will see a list of subscriptions that are charged to your account or card.

Tip: You can also access Subscriptions under Payments and e-invoices starting with mobile banking version 4.23.

Is one of your accounts or cards missing from Subscriptions? Adjust the settings on the Insights tab to select which accounts and cards you want to include in your insights.

How to manage subscriptions

If there’s a subscription missing from the list, you can add it manually.

- Tap the plus sign at the bottom of the page.

- Select the transaction that is related to a subscription.

- Mark the transaction as a subscription.

If you don’t want to see a subscription on the list, you can hide it. Select the subscription and use the slider to hide it.

How to cancel a subscription

- Select the subscription you wish to cancel. Select ‘Cancel subscription’, follow the steps in the app and fill in your details.

- We will ask you to sign an authorisation digitally so that we can cancel the subscription for you.

- We can then handle the cancellation process on your behalf. Your subscription will usually be cancelled in 5 days or less. You will receive a confirmation when the subscription is cancelled. You will also be notified if the subscription can’t be cancelled for some reason. In such a case, please contact the service provider directly.

Note: There are some subscriptions that can’t be cancelled in Nordea Mobile, such as fixed-term subscriptions.

.svg)