How to select a rate of return

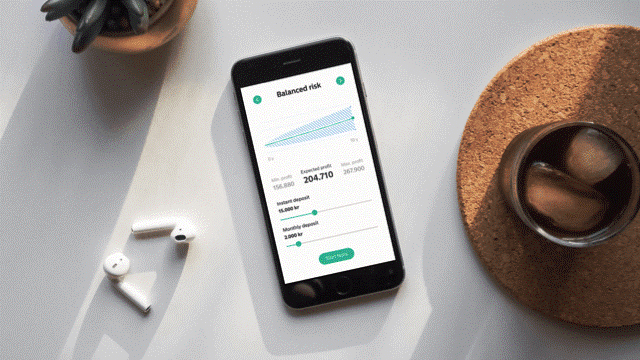

Our compound interest calculator helps you see how much return you could expect on your investment.

- The return expectation is a couple of percent for extremely safe investments and potentially 3–5% for investments with an average risk.

- If you are a high-risk investor trading in equities, your rate of return could be above 6–7%. Historically the equity markets have grown on average by around 7% annually.

You can mitigate your risks by diversifying your savings or investments. We recommend that you do this by investing in different asset classes, such as equities and fixed-income securities, as well as in various industries, countries or regions.

You can set the annual rate of return to 7%, for example, as the equity markets grow on average by around 7% annually based on historical data. It’s good to remember that the value of your investments may rise or fall. In some years you get a high return on your investments and in some years you make a loss. However, in the long term the average return is typically positive.

Please note that we cannot guarantee that you will reach the rate of return shown in the savings calculator even if you follow the corresponding investment strategy. The savings calculator is meant to illustrate the returns you could gain depending on the amounts, savings period and rate of return you select. The value of and/or the return on your fund units, equities and other investment or savings products may increase or decrease with market movements and it is not certain that you will get back the entire amount you invested.

.svg)