How do fund and equity investments differ?

Both funds and equities offer good returns in the long term. So what’s the difference? You can compare this decision with buying a cake versus buying the ingredients and baking the cake yourself.

Investing in a fund is like buying a cake. When you invest in a fund, you get a complete package compiled by the fund management company. It’s a convenient solution if you don’t want to spend a lot of time managing your investments and prefer to have experts make the investment decisions for you. You can select from different types of funds. For example, an equity fund mainly invests in equities and a bond fund mainly in the bond market. A fund that invests in both the bond market and the equity market is called a balanced fund. When you invest in a fund, you are buying fund units.

When you invest in a limited liability company, you are buying shares. A share represents the investor’s stake in an individual company. When you buy shares, you need to compile your own package in order to diversify your risks. Investing in equities requires a little more knowledge and a keener focus than investing in funds.

- If you want, you can start saving in both funds and equities and divide your assets between them as you wish. And if you would like to buy a different type of cake, you might want to look into insurance-based investments.

Where to invest in uncertain markets?

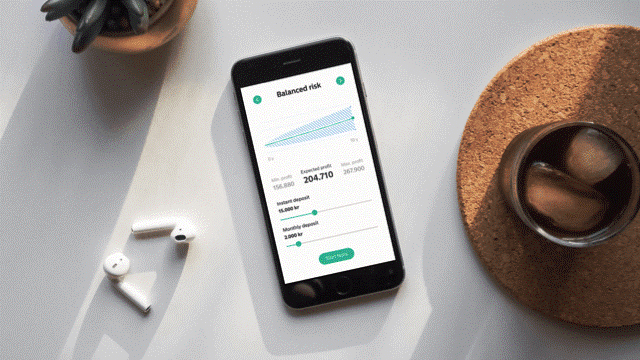

Even amongst market uncertainty you can easily diversify your investments by saving into a fund each month. See our fund selection to find the funds that suit your risk level and investment horizon the best. Discover the benefits of monthly saving.

.svg)