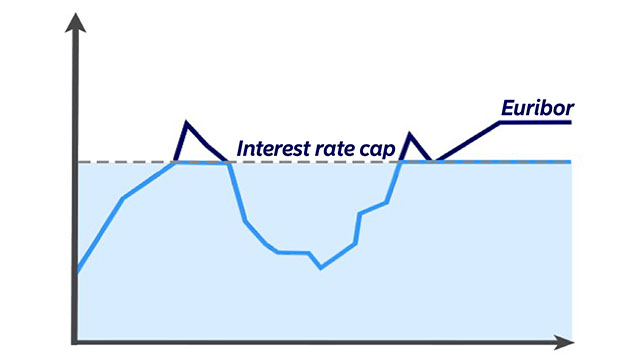

You can add an interest rate cap to your loan to set a maximum level for the reference rate during the validity of the interest rate cap.

Example: You take out a loan of 155,000 euros and the loan period is set at 23 years. The agreed reference rate is the 12-month Euribor and the margin is 0.52% (September 2025). You choose an interest rate cap of 3.50% for 10 years. This means that the total interest rate of your loan cannot rise above 4.02% during the validity of the interest rate cap. The APR is 2.8%, including an opening fee of 620 euros and a monthly fee of 2.50 euros for the automatic debiting of loan payments. Any fees for the interest rate cap have not been taken into account in the calculation of the APR. The number of payments is 277. The total amount of the loan and loan costs is 209,930 euros. The monthly payment (annuity) is 756 euros and does not include the interest rate cap fee which is paid separately.

The loan amount, the loan period and the interest are a representative example for the home loans offered by Nordea. The example is indicative and has been calculated using certain assumptions. The example does not necessarily correspond to the actual APR charged on the granted loan.

When buying a home, you also need to pay the costs related to the registration of ownership and pledging of your home. You also need to see to it that your home insurance is up to date. In case of a property, you will need fire insurance at the least. In some cases, we need the help of a real estate agent to determine the value of your home. We will charge a fee for this service.

.svg)