- Savings Fixed Income – a bond fund investing in the fixed income markets.

- Savings 15 – a fund with a focus on fixed income investments, where the weight of equities in the portfolio is about 15%.

- Savings 30 – a fund with a focus on fixed income investments where the weight of equities in the portfolio is about 30%.

- Savings 50 – a balanced fund, where the weight of equities in the portfolio is about 50%.

- Savings 75 – a fund with a focus on equity investments where the weight of equities in the portfolio is about 75%.

What is a balanced fund?

Balanced funds offer a convenient way to make a broadly diversified investment across the equity and fixed income markets. Our experienced portfolio management team tracks the markets, assessing the opportunities they offer and making investment decisions on your behalf. As their name implies, balance funds contain a balanced mix of equity and fixed income investments.

How to choose the most suitable balanced fund

We offer a broad selection of balanced funds that are suitable for various types of saving goals. Here are some things to think about when choosing a suitable balanced fund:

- Balanced funds invest in both equities and fixed income instruments with various weights. The more a fund focuses on equities, the higher its expected return and risk. The more it focuses on fixed income investments, the lower and more stable its expected return and risk.

- Think about how much risk you’re willing to tolerate, what kind of return you’re seeking and how long you wish to hold your investments. Read each fund’s key documents, where you will find out about its structure, expected return and risk profile.

Remember that the same principle applies to balanced funds as to any other funds: risk and return go hand in hand. A higher expected return results in a higher risk and more volatility in the value of the fund. You will usually find a suitable fund by exploring our selection and thinking about your investment goals.

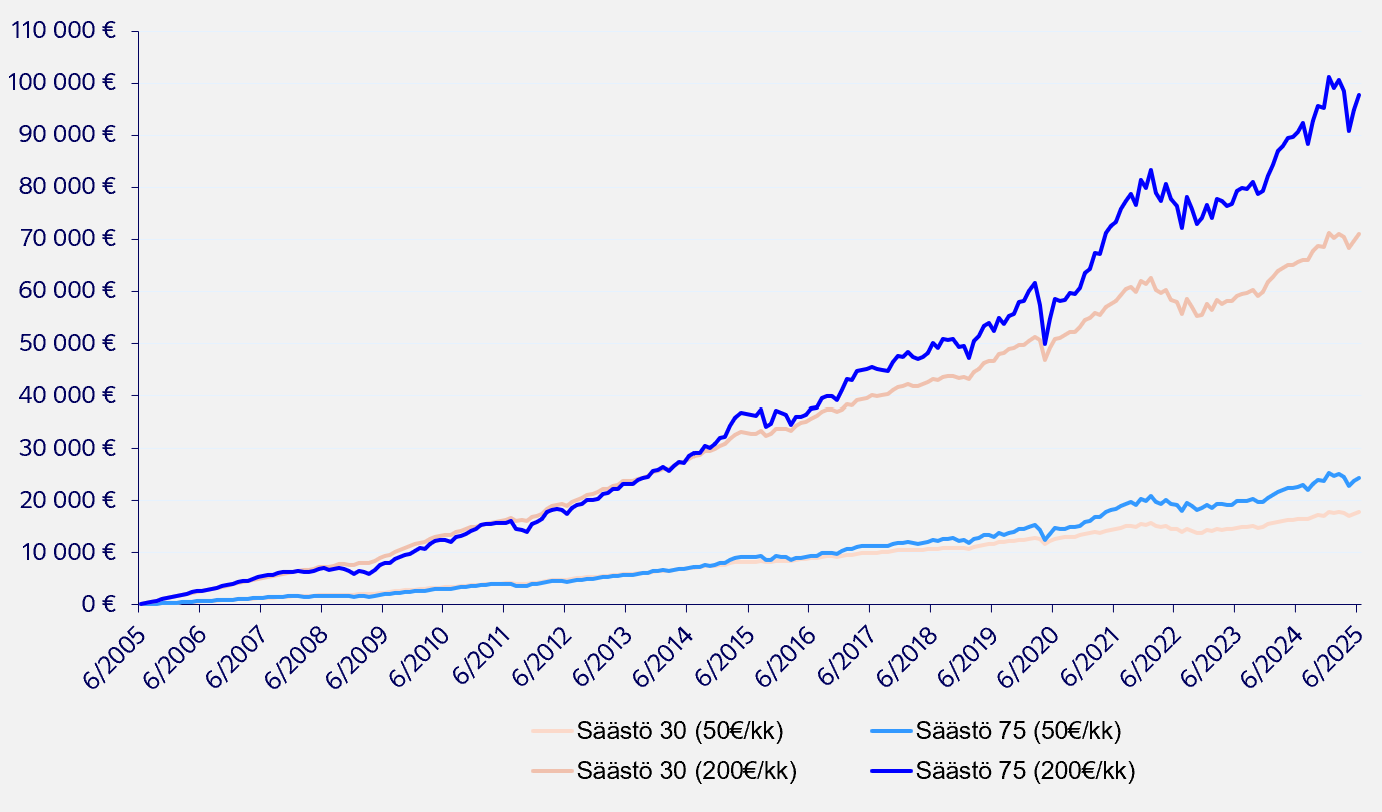

See how the weight of equities and the invested amount affect the return on investment.

.svg)