Financial security with an interest rate cap

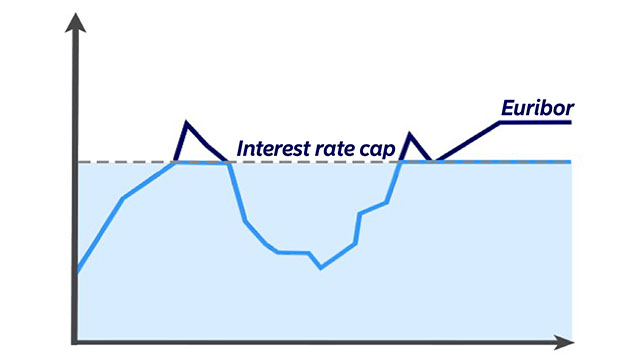

An interest rate cap prevents your monthly payment from exceeding a certain limit, adding stability to your finances. If your loan has an interest rate cap, you can focus on your new home without needless stress.

Benefits of an interest rate cap

- Protects your loan from a sharp rise in the reference rate. The interest rate will not exceed the agreed cap level even if the reference rate rises above it.

- On the other hand, you will benefit whenever the Euribor rate goes down – all the way to zero per cent.

- A loan with an interest rate cap is as flexible as any other home loan, and by using FlexiPayment, for example, you can increase or decrease your monthly payment without asking us first.

The free interest rate cap for a new home loan may have different features than other interest rate caps. This includes the validity period and cap level, for example. The loan period and repayment schedule can be agreed freely, but the loan period must be at least as long as the validity of the interest rate cap.

We will agree with you on a free interest rate cap during the loan negotiation, but the precise level and validity of the cap will be set when you draw down the loan. This interest rate cap is available for up to 3 years.

.svg)