![]()

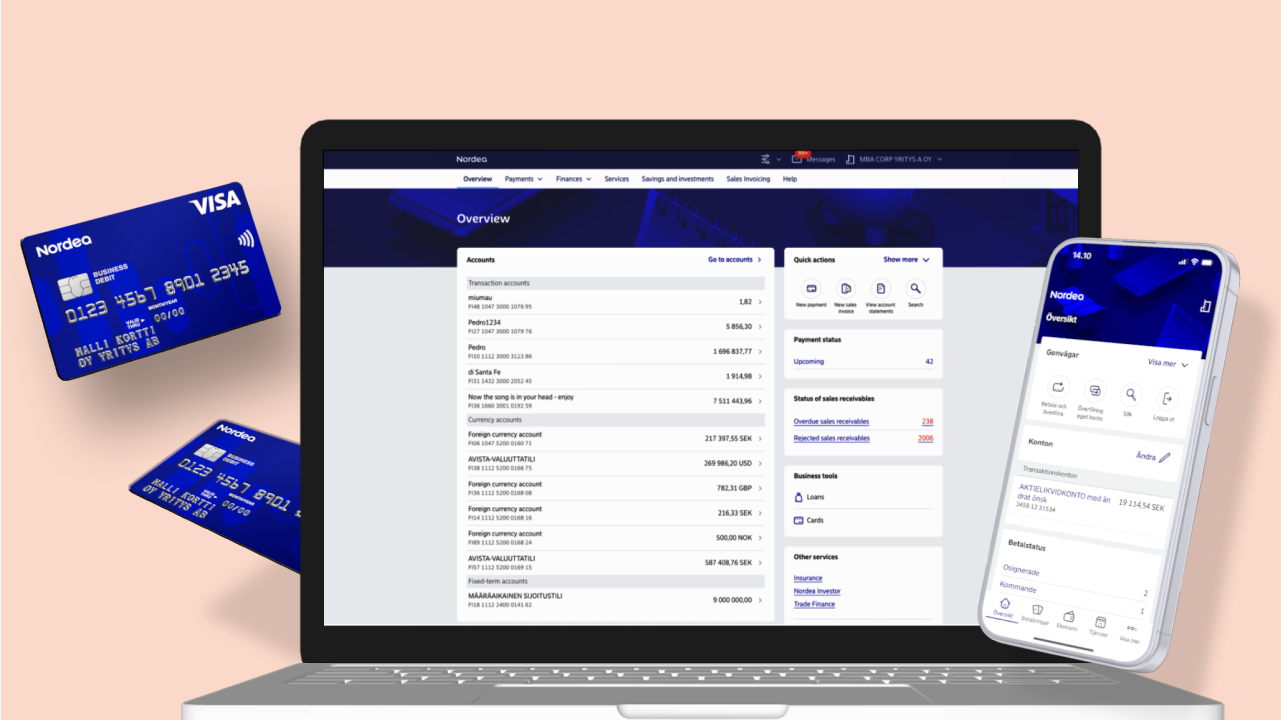

- Stay on top of your cash flow with Nordea Business

- Customisable authorisations and easy user management in Nordea Business

- Payment solutions for domestic and international transactions alike

Nordea Business was named the best business banking application in the Nordics in 2025.

Whatever your needs, we offer a variety of services to make running your business easier.

Free up more time for running your business. Get a comprehensive digital service package to make your life easier.

Businesses with up to 50 employees. Our insurance policies, cards and customisable online banking authorisations are designed to make running your business easier at every stage.

Businesses with 50 to 250 employees and a need for extensive solutions for handling payments and invoices. We are here to help your business grow and to provide you with expert advice on anything from financing to investments.

Explore our wide range of services and find the products that meet your needs.

![]()

Are you looking for expert advice on how to grow your company? We are here to support you and to find the right solutions for your company, regardless of its size or industry.

Our experts are on hand to help you with payments, financing, savings and investments as well as foreign trade.

You can reach our advisers through the Nordea Business chat Mon–Fri 8.00–18.00, and Nordea Business Centre is at your service Mon–Fri 9.00–16.30 on 0200 26262 (local rates apply).