Manage your company’s interest rate risk

The more variable-rate debt your company has, the higher the risk involved in interest rate fluctuations. We will take a holistic view of your loan portfolio, and when your company’s situation changes, we will help you find new solutions.

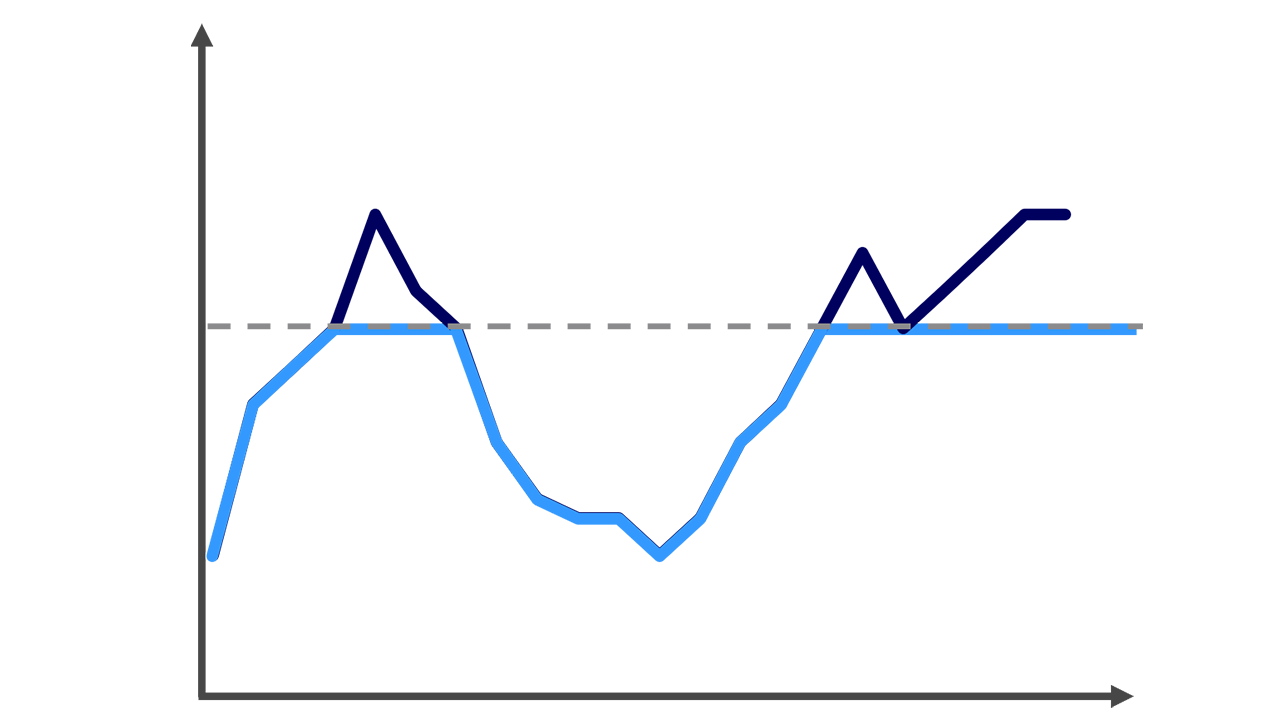

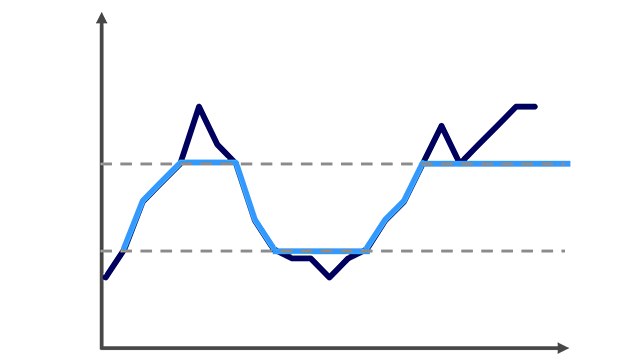

You can manage your company’s interest rate risk with different solutions, the most typical of which are the interest rate swap, interest rate cap and interest rate collar. These hedges will be adjusted to suit your company’s profile, taking into account the market situation.

.svg)