A stable economic outlook

January’s macroeconomic backdrop continued to support a relatively steady investment environment. The International Monetary Fund raised its forecast for global GDP growth in 2026 to 3.3 per cent. This revision reflects, in particular, the strengthening wave of AI related investment and the global economy’s gradual adjustment to the higher US tariff levels introduced earlier. Inflation is expected to develop moderately, supporting consumer purchasing power and reducing the risk of near term monetary tightening. The IMF nonetheless notes that valuation levels have risen sharply following the technology driven rally, increasing the risk of overheating in financial markets.

Economic performance in the United States remained strong in the latter half of last year. GDP expanded at an annualised rate of 4.4 per cent in the third quarter, and the Atlanta Fed’s GDPNow model forecasts growth of more than five per cent for the final quarter. The expansion is underpinned by resilient private consumption, the momentum of AI related investment and improving export demand.

Growth in the euro area is also expected to pick up this year, although the pace recorded at the end of last year did not match that of the United States. The euro area economy is estimated to have grown by just over one per cent year on year in the final quarter.

Robust earnings growth in the United States

The fourth quarter earnings season in the US has begun on a positive note. Profits for companies in the S&P 500 are expected to rise by about 11 per cent from a year earlier, lending further support to equity markets. Technology giants are again anticipated to account for the majority of this growth, with earnings forecasts exceeding 20 per cent, whereas the rest of the index is projected to grow at a more modest pace of around four per cent. Corporate guidance for 2026 has been cautiously optimistic. Investment in AI and automation is expected to continue, while companies simultaneously emphasise the need to safeguard profitability in the face of economic uncertainty. Markets have reacted with notable sensitivity to any deterioration in outlook. High valuations leave little margin for disappointment.

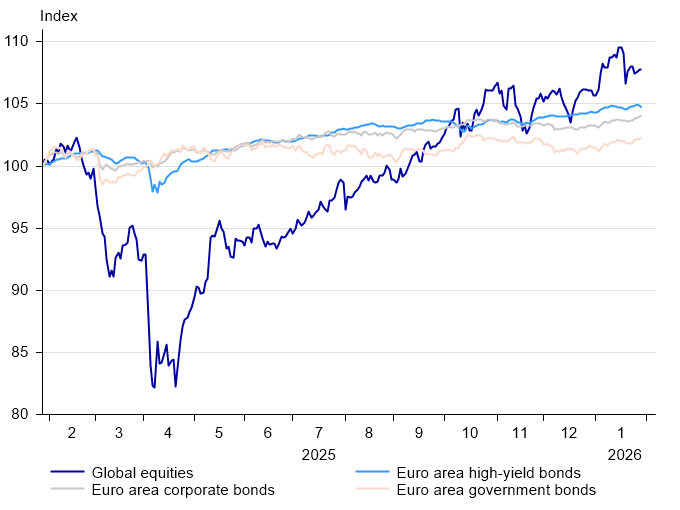

Equities continue to offer the strongest return potential

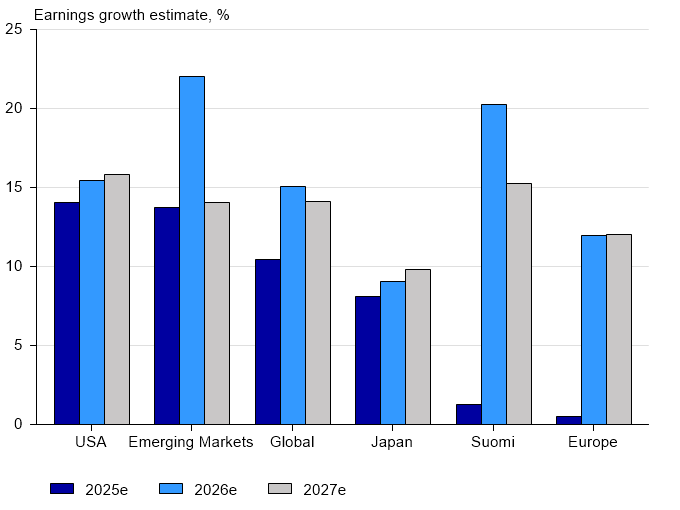

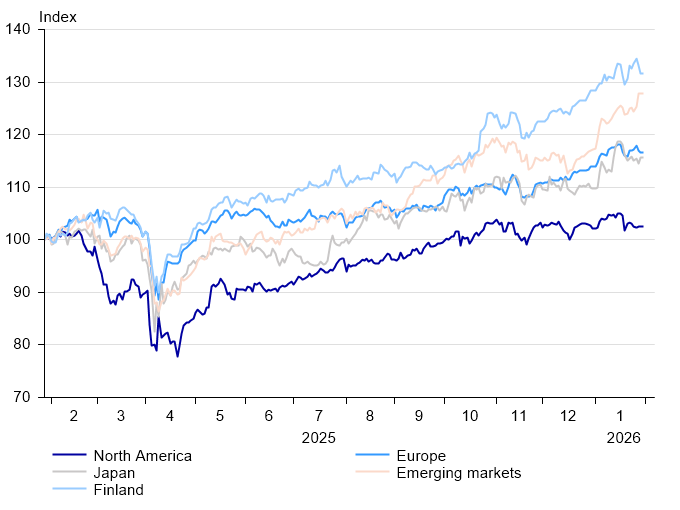

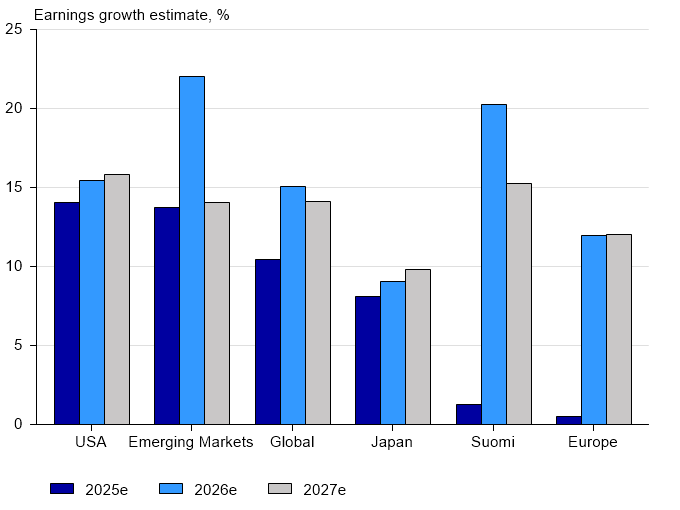

Nordea’s House View continues to favour equities. Strong and broadening earnings growth is expected to underpin further positive market development. Regionally, Europe remains overweight in our recommendations, based on expectations that an improving economic environment and lighter regulation will support corporate earnings. North America, Finland and emerging markets remain at neutral weight, while Japan stays underweight.

Corporate earnings growth is expected to improve in all geographic regions this year.

Healthcare and financials are viewed as the most attractively valued sectors with stable growth prospects. The outlook for consumer staples is weaker, and the sector remains underweight in our recommendations.

.svg)