While the equity savings account is a simple tool for those who want to save in equities, a book-entry account makes sense in some cases. So what are the things you need to know when weighing between these two options?

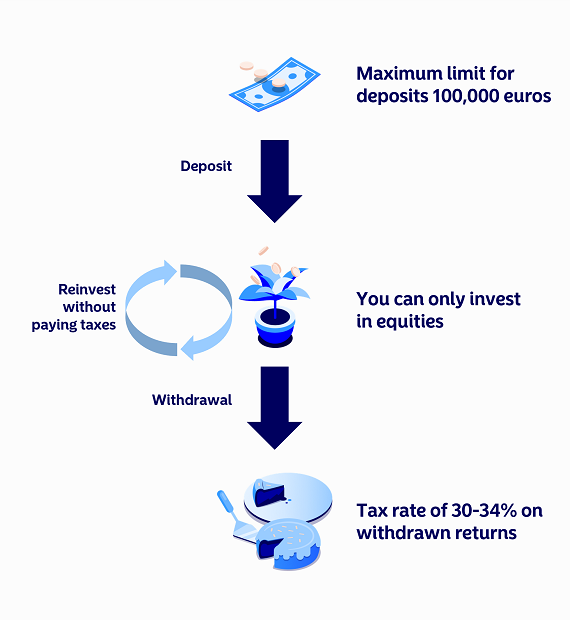

At the beginning of 2020, Finnish equity savers were given a brand new alternative to the traditional book-entry account with the introduction of the equity savings account. The equity savings account resembles a book-entry account, but allows private individuals to trade in shares without having to pay taxes immediately. An equity savings account agreement is composed of a cash account to which the saver deposits money as agreed and of a custody account for securities (book-entries).

The key difference between the equity savings account and book-entry account is taxation. If you have an equity savings account, you don’t need to pay tax for capital gains and dividends in the year you receive them. Instead, you will pay taxes when you withdraw money from the account. This enables you to take full advantage of compound interest. As the choice between these two options fully depends on your particular circumstances and needs, you should always make a comparison based on them to assess which one is the better option for you. Many investors have also decided that they need both accounts and use them in parallel for different purposes.

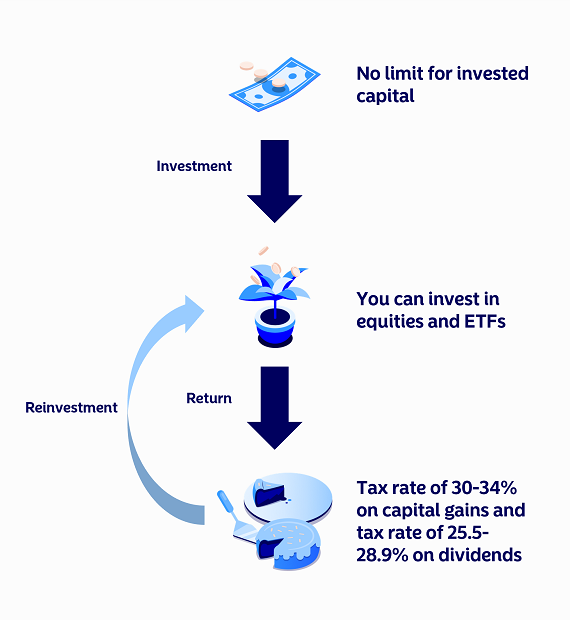

In general, the equity savings account suits savers who invest in equities in the long term and are active traders, whereas the book-entry account suits buy-and-hold investors and investors who want to diversify their portfolios by investing in exchange-traded funds (ETFs) or other exchange-traded instruments.

See below for a more detailed comparison of the differences between an equity savings account and a book-entry account.

| Equity savings account | Book-entry account | |

| Eligible owner | Private individual | Private individual or company |

| Limit for deposited capital | 100,000 euros of invested capital No maximum limit for account value | Unlimited |

| Number of accounts | Only one per private individual | Unlimited |

| Eligible securities | Finnish and foreign shares | Finnish and foreign shares, ETFs and other exchange-traded instruments |

| Taxation of returns | Tax rate of 30–34% for capital income levied on withdrawn returns* Paid for the year in which the returns are withdrawn from the account | Tax rate of 30–34% for capital income levied on capital gains Paid for the year in which the securities are sold |

| Taxation of dividends | No tax levied on dividends** | 85% of dividends are considered capital income subject to a tax rate of 30–34%*** |

| Deemed acquisition cost | Not applicable | Applicable |

| Deductions for capital losses | No right to deduct capital losses arising from single equities. If you suffer a loss when you terminate the account, the loss can be deducted. | Capital losses can be deducted from capital income during the current year and 5 subsequent years. |

**) Dividends are not taxable in Finland, but if you have foreign shares, the country in which the foreign company is domiciled may levy a tax-at-source on dividends paid by such companies, depending on the tax treaties between Finland and the country in question. For example, dividends paid by companies domiciled in the US or Sweden are subject to a tax-at-source of 15%.

***) Due to the tax-free share, the effective tax rate is 25.5–28.9%. If you have foreign shares, the country in which the foreign company is domiciled may levy a tax-at-source on dividends paid by such companies. However, in contrast to the equity savings account, the tax-at-source levied on dividends paid to a book-entry account is typically refunded in Finnish taxation.

.svg)