How should our loan customers prepare for a rise in interest rates?

The monthly home loan payment is often the largest single expense in a household. It’s therefore good to consider how much higher interest costs you can afford so that your home loan costs will also leave you room to save some money, pay your normal day-to-day expenses and spend on things you enjoy.

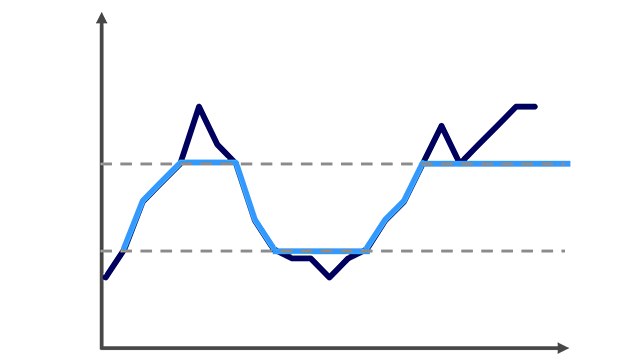

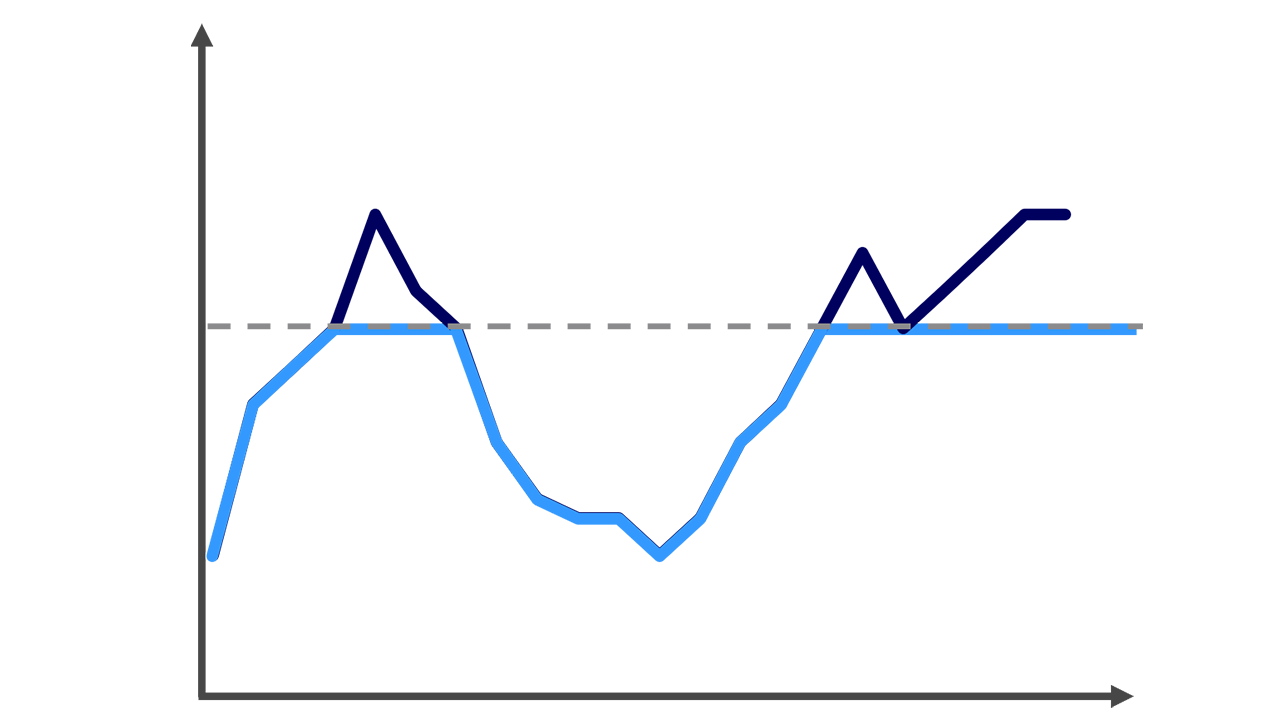

- When you hedge against the interest rate risk in full or in part, it’s easier for you to plan and manage your finances.

- By hedging an investment loan, you can ensure that your investment remains profitable despite interest rate fluctuations.

- With an interest rate hedge, it’s more likely that you can continue to follow your savings plan and won’t have to cover the higher interest costs with your savings or investments.

.svg)